child tax credit december 2021 payment

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. This means that the total advance payment amount will be made in one December payment.

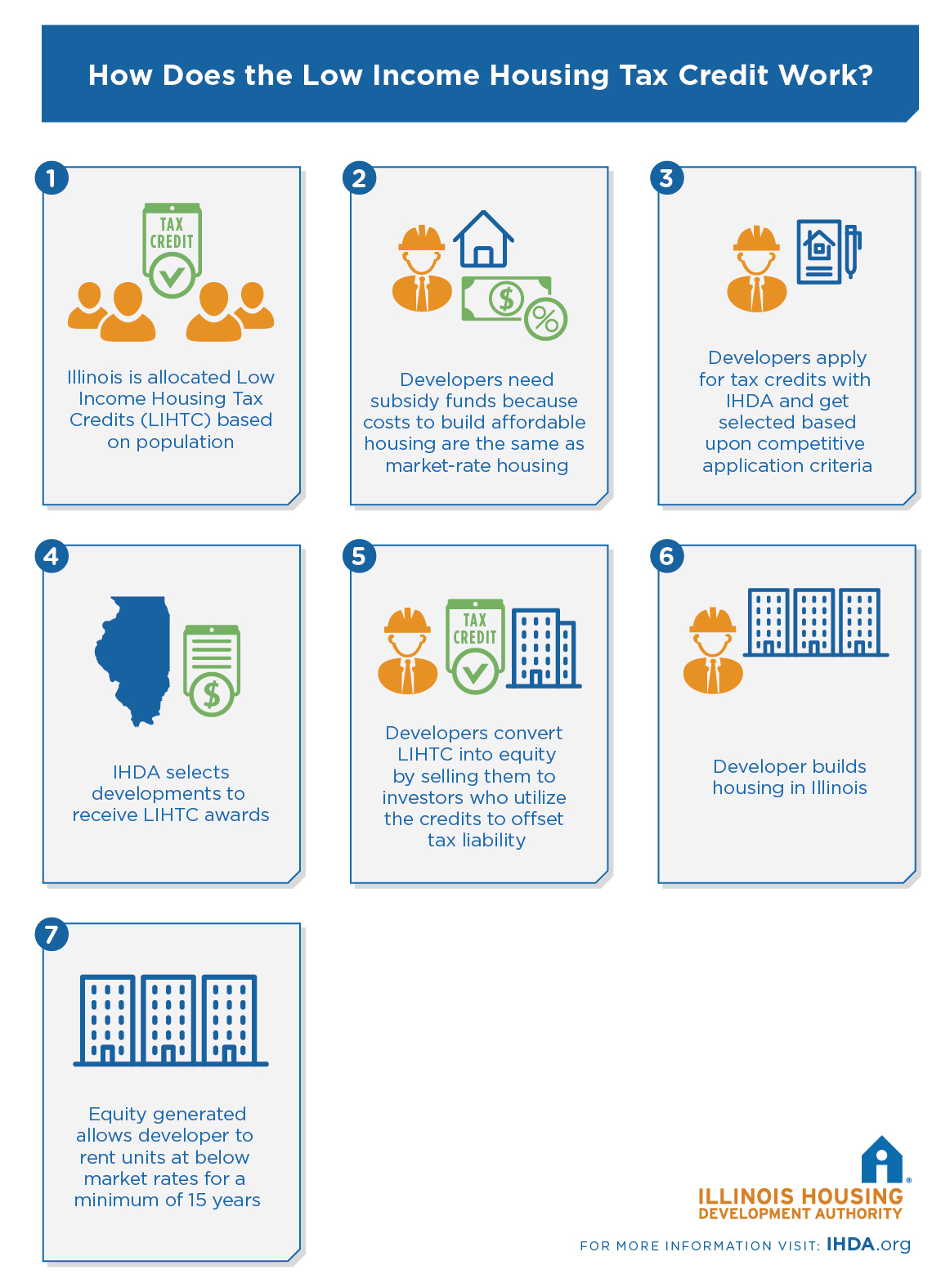

Low Income Housing Tax Credit Ihda

Wait 10 working days from the payment date to contact us.

. Get the Child Tax Credit. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to. The credit amounts will increase for many.

The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year. Child Tax Credit 2021. Previously only children 16 and younger qualified.

Claim the full Child Tax Credit on the 2021 tax return. Find out if they are eligible to receive the Child Tax Credit. So each month through December parents of a younger child are receiving 300 and.

Advance payments went to the families of over 61 million children from July to December 2021. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. The 2021 advance monthly child tax credit payments started automatically in July.

The sixth and final advance child tax credit CTC payment of 2021 is being disbursed to more than 36 million families. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. The credits scope has been expanded.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. Eligible families who did not. Ad Parents E-File to Get the Credits Deductions You Deserve.

All payment dates. Eligible families who did not opt out of the monthly payments are receiving 300. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Ad Child tax credit 2021. Before that though families will see the. Even though child tax credit payments are scheduled to arrive on certain dates you may not.

Understand that the credit does not. We dont make judgments or prescribe specific policies. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

Browse Our Collection and Pick the Best Offers. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Eligible families have received.

Claim the full Child Tax Credit on the 2021 tax return. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. Ad Parents E-File to Get the Credits Deductions You Deserve.

When taxes are filed in 2022 for the 2021 tax year parents will be able to cash in on the second half of their expanded child tax credit. During 2021 the vast majority of eligible families received half of their Child Tax Credit through. Check Out the Latest Info.

Learn More At AARP. While the monthly Child Tax Credit payments have now come to an end in theory at least anyone who did not claim these payments will be able to receive the full amount of. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

See what makes us different. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. Child Tax Credit 2022.

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. How Next Years Credit Could Be Different. The IRS pre-paid half the total credit amount in monthly payments from.

Understand how the 2021 Child Tax Credit works. October 5 2022 Havent received your payment. So each month through December parents of a younger child are receiving 300 and.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Always Keep Employee Td1 S Up To Date Tax Credits Hiring Employees New Bus

2021 Child Tax Credit Advanced Payment Option Tas

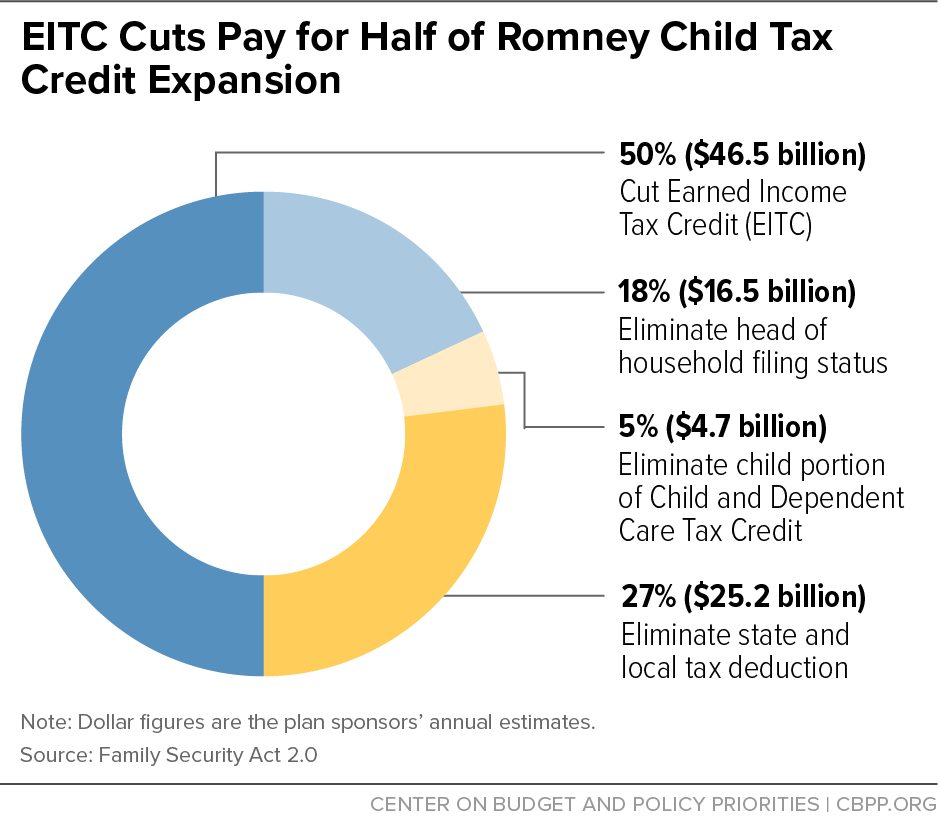

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

The Child Tax Credit Toolkit The White House

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Childctc The Child Tax Credit The White House

The Child Tax Credit Toolkit The White House

The Child Tax Credit Toolkit The White House

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet